How to avoid losses when trading derivatives?

Derivative securities are characterized by strong and rapid price fluctuations due to the use of high leverage. Therefore, investors need to master knowledge and be mentally prepared to avoid buying/selling too much during the day according to price fluctuations, leading to losses. So how to avoid losses when trading derivatives ?

Avoid losses when trading derivatives

If you are a new investor, some experiences below will help you avoid losses:

Develop trading methods

When participating in the derivatives market, the first thing you need is to have a clear strategy, avoid falling into two extremes:

- Buy and sell too much in one day

- After entering the order, leave it alone without paying attention to the order status

Unlike underlying securities, investors have T+2.5 time to wait for stocks, derivative securities do not have a waiting period.

Investors can buy/sell immediately, so there will be many decisions made at a time and there are not many trends during the day. This leads to possible fees and losses due to opening/closing too many positions in a short period of time.

Understand the rules of derivatives trading

The rule of derivative securities is: There are no rules.

See derivatives developments in 1 session

Therefore, investors must always comply with risk protection principles. Only bet on the actual movements of VN30 hourly, day by day and always monitor the chart’s fluctuations with 3 time frames: 3M, 5M, 15M. When VN30 has strong fluctuations (increase/decrease), you should only look at the 1M chart to find the profit taking point when you see signs of candle reversal.

Short-term investment and partial profit taking

It should be noted that this is a short-term speculation channel, we will trade and close the position in the short term but cannot hold it long-term like the underlying stock, because the derivative must settle the position at maturity.

The best way is to take profits during the day and not open positions overnight. Since profit/loss calculation will be calculated daily, you can take profit in parts on the day of opening the position.

Pay attention to transaction time

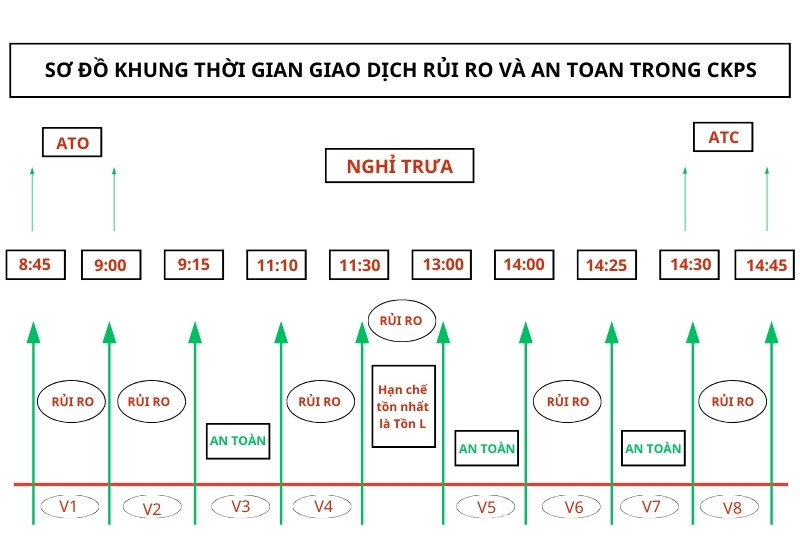

Safe and risky trading time frame

Normally, the morning session will be easier to profit and less risky because it fluctuates up and down every 4 minutes. The afternoon session is very risky, especially at the end of the session. The Drive group can suddenly push the price up because they know investors like to cut losses at that time.

Capital preservation rules

- Investors should remember to always set a stop-loss ratio before opening a derivatives trading position.

- Before opening a position at any price, determine the stop-loss price before determining the take-profit price.

- Reasonable capital allocation helps investors avoid going “all in”.

- You can allocate derivative transactions with ¼ of the capital in your account to not lose much.

- Avoid psychological pressure when suffering losses, call margin.

Manage personal emotions

Psychology is a factor that greatly affects success in derivatives. High leverage can cause strong emotional fluctuations, making decisions difficult.

Investors need to manage 4 emotions: “Greed – Fear – Hope – Regret”. Among them, the emotion “Greed” is the strongest.

To manage the above emotions, you need to follow the following 4 principles:

- Trade strategically and tactically.

- Use Technical Analysis to find entry and exit points.

- Stop Loss, Stop Profit Principle.

- The principle of stopping trading when reaching the profit target or loss target.