Instructions on how to set Stop Loss on Binance in the simplest way

If you are an investor participating in the financial or cryptocurrency market, you are probably no stranger to the phrase Stop Loss. But for F0 investors just entering the markets, this is a new term. Therefore, today, Finhay will answer your questions about what Stop Loss is as well as instructions on how to set Stop Loss on Binance.

How to set Stop Loss on Binance Future and Spot

What is a Stop loss order?

Stop Loss is an automatic stop loss order that helps traders preserve capital in case they misjudge the market trend. This order will be activated when the price of the coin or token drops below the threshold set by the user.

For example: The current price of ETH is 1100 USDT/ 1 ETH. You place a stop loss order with the following structure: If the price of ETH drops to 1050 USDT/ 1 ETH, an order to sell ETH at 1049 USDT/ 1 ETH will be activated to cut losses promptly, not letting the price of ETH fall too much. leads to more losses for investors.

How to set Stop Loss on Binance Futures

Binance has several types of orders in the Futures, Spot or Margin markets that support placing Stop Loss and Take Profit orders right after opening a transaction: Market orders and Limit orders.

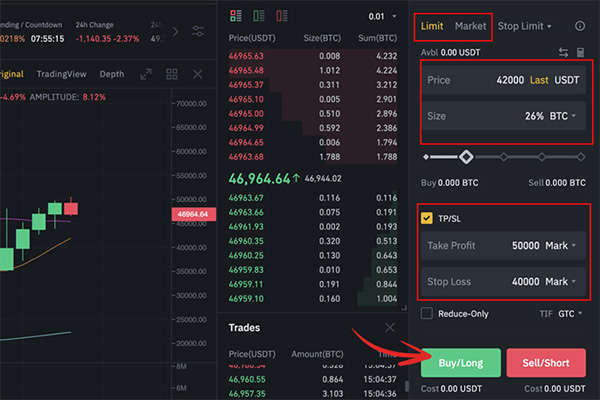

How to set Stop Loss and Take Profit levels when trading on Binance Futures as follows:

- Step 1: Choose the type of order you want to trade: Limit order or Market order.

- Step 2: Fill in the trading volume. For Limit Futures orders, fill in the price you want to match the order.

- Step 3: Check the box to select TP/SL.

- Step 4: Fill in TP take profit level, this level needs to be higher than the order matching price.

- Step 5: Fill in the SL stop loss level, this level needs to be lower than the order matching price.

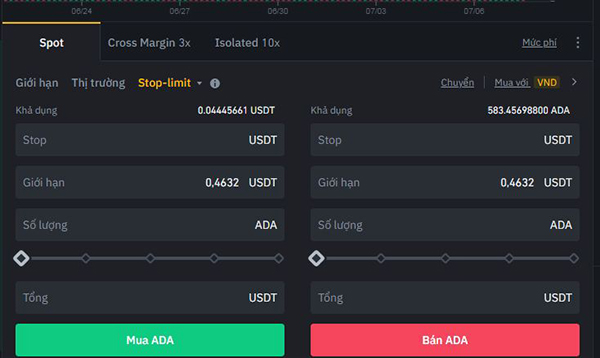

How to set Stop Loss on Binance Spot or Binance Margin

To place a Stop Loss order, you need to use a Stop – Limit order to set a stop loss order for your active transactions.

After opening an order to buy cryptocurrencies, you need to open an additional Stop – Limit order to set a stop loss for the following transactions:

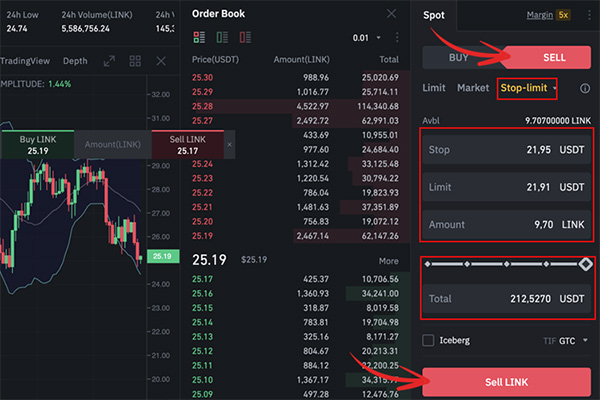

- Select the Stop – Limit order type that appears on the order window

- Enter the price you want to activate the Stop Loss order in the Stop box

- Enter the price you want to sell coins in the Limit box

- Enter the number of coins you want to cut losses in the Amount box.

- The amount you receive after the stop loss order is completed will be displayed in the Total box.

For example: You have 9.7 LINK coins in your Spot wallet and want to set Stoploss at 22.91 USDT so that if the market goes down you won’t suffer much loss. You follow these steps:

- On the transaction screen, select the SELL tab

- Select the order type as Stop-Limit

- Place a Stop Loss order at 21.95 USDT

- Place a Limit order at 21.91 USDT

- Set Amount: 9.7

If the price falls to 21.95 USDT, this order will sell your 9.7 LINK at 21.91 USDT. At that time, you will collect a total of 212.5270 USDT in the Spot wallet.

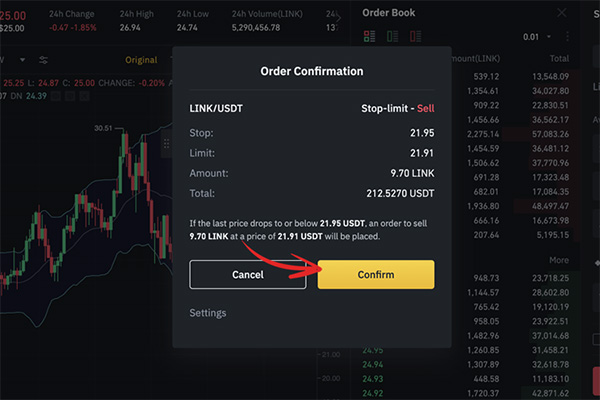

After placing the order, a window will appear asking to confirm the Stop Limit order. Click Confirm to confirm the order you just placed.

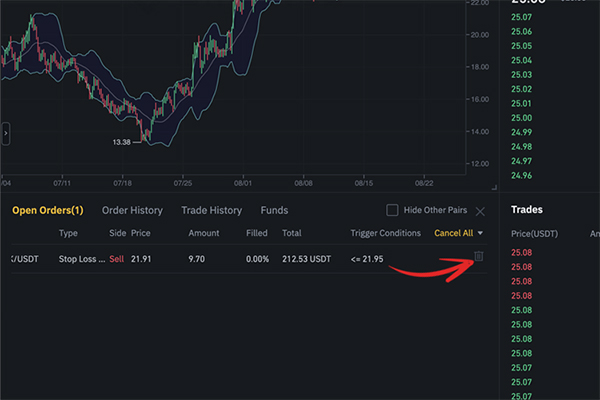

Your order will appear in the Open Order window (pending order). If you want to cancel the Stoploss order you just placed, click the Cancel icon at the end of the order line.

How to place a Stop Limit order on Binance

When placing a stop loss order, you should not ignore the Stop Limit order on Binance. Stop Limit is a type of stop limit order, allowing investors to buy/sell trading assets at a predetermined price. How to set Stop Limit on Binance according to the following steps:

- Step 1: Log in to Binance then select the transaction method.

- Step 2: Select the currency pair you want to trade. Scroll down and you will see the order ranges. Then you choose Stop Limit.

- Step 3: You fill in the parameters, including:

- Stop: Is the price that will trigger the limit order

- Limit: Is the price at which the buy and sell order will be activated

- Quantity: Number of coins or tokens you want to buy.

- Step 4: Check the information again then confirm the transaction.

Note: The Stop Limit order will only be executed when your limit price is reached. Sometimes, the price drops too quickly and your limit order is ignored. In this case, you can use a market order to exit the trade.

Common mistakes in placing Stop Loss

Below are the most common mistakes that traders often make. You should avoid it to minimize risks as well as improve trading efficiency.

Set Stop Loss too close

The essence of placing Stop Loss is to limit risks and losses when trading. Therefore, many people are afraid of risk so they place Stop Loss too close to lose less. However, placing orders like this often causes traders to get more Stop Loss.

For example, the price is rising and traders place a Stop Loss order too close, causing the price to just go past the stop loss level and immediately return to Take Profit. Cause your Stop Loss order to backfire and lose some of the profit you would have achieved.

Therefore, before placing an order you need to conduct careful analysis to set an appropriate Stop Loss level. You should be prepared to ask yourself questions such as: How much percentage of my total account can I risk on 1 order? What is the most reasonable loss amount to enter an order with?

Questions like these will help you anticipate the worst situations for each order entry. If the market goes against your expectations, it won’t affect your account too much.

Set Stop Loss too far

The opposite of placing Stop Loss too close is placing Stop Loss too far. When placed this far away, two cases will occur:

- One is that you will earn a large profit without worrying about being stuck in SL immediately, without fear of the price going to that point and then turning back.

- Second, the account will suffer huge losses if it reaches the Stop Loss level you have set.

Changing the Stop Loss set point is not according to the rules

This shows your lack of discipline, fear and anxiety when entering orders. If the previous market gave you good signals for you to Buy or Sell and find a nice entry point with reasonable Stop Loss and Take Profit, you should stick to your principles.

Dare to take risks, dare to take risks or hit Stop Loss or Take Profit, don’t look too much at the chart which leads to bad psychology. This will gradually form good habits in trading, bringing yourself into the discipline of the general framework.

On the contrary, when you are not sure about your decision, you will often look at the chart. If you set it too far, when the order gets close to the Stop Loss, you will be scared and quickly move the Stop Loss to a level closer to the original level. Or if you place it too close, when the order is about to hit the Stop Loss, you want to make more profits and move the Stop Loss further. This is no different from not placing a Stop Loss.

When should you use Stop Loss and Stop Limit orders?

In highly volatile markets with rapid price fluctuations, Stop loss orders can limit risks. Investors often use this type of order when they do not want to risk the entire transaction or part of the transaction.

No trader, even professional traders, cannot accurately predict what is going to happen next in the market. Therefore, you need to set Stop Loss every time you enter an order, especially when the market fluctuates strongly. This helps keep your account safe. Setting a Stop Loss order with price fluctuations is a strategy that helps traders limit losses when the market goes against expectations.

Similar to Stop Loss, Stop Limit is also an effective risk management tool for many investors. However, it is not always possible to apply these commands. Specifically: you should only use Stop Limit orders in the following cases:

- There is little time to monitor the market

Stop Limit is suitable for investors who have little time to monitor the market. Because this order will be automatically matched according to the price you have set. Setting a Stop Limit will help you not miss out on opportunities and avoid unnecessary losses.

- The market has small fluctuations

For markets with small fluctuations and in a sideways period, investors can set a Stop Limit to time the reversal. Choosing the right time before the boom will give you a reasonable entry price and higher profits. On the contrary, when the market drops, using Stop Limit also helps you have reasonable stop-loss points, avoiding exits and sell-offs.

Above are instructions on how to set Stop Loss on Binance. Thereby, you also know what the Stop Loss order is or when the Binance Stop Limit order is used effectively. It is important that traders realize the importance of setting Stop Loss orders in trading. Successful traders always consider placing Stop Loss orders as essential. Therefore, F0 investors should not ignore this principle.