What assets are more likely to become tools of financial crime than cryptocurrencies

Main contents

- Despite the steady adoption of digital assets and the maturity of the industry, there are still suggestions that cryptocurrencies are primarily a tool for financial crime, ignoring evidence of a secondary role and the increasing decline of cryptocurrencies in illegal transactions.

- Europol data shows that real estate, luxury goods and cash-intensive businesses are the main money-laundering tools for major EU crime networks, with cryptocurrencies accounting for just one billion. humble rule.

- Reports from NASDAQ and the US Treasury Department illustrate the significant disparity between the volume of illicit funds in the traditional and digital asset sectors – with the digital asset sector being the only accounts for a small portion of the total.

It’s 2024 and Wall Street firms – led by the world’s largest asset manager BlackRock – are racing to offer indirect bitcoin investing to traditional investors through products Managed portfolio swaps. Around the world, millions of people use digital assets to preserve the value of their savings amid rising inflation and devaluation of local currencies, as well as to take advantage of cross-border remittances. almost instantly with low fees. Traditional sectors from philanthropy to the arts are being innovated and reshaped with new efficiencies and features that come from using blockchain technology.

Yet, strangely, there are still those who stubbornly refuse to acknowledge the progress the digital asset industry has made in recent years, instead sticking to clichés that are never true. or is too outdated. They argue that cryptocurrency is no different than an online casino whose main use is to facilitate money laundering and other crimes. This has led the most extreme skeptics to call for digital assets to be banned from existence or outlawed.

Reliable data shows the rate of illegal cryptocurrency trading in 2023 at a modest 0.34%, down from 0.42% the year before or digital asset value received by illegal addresses is small and down year-on-year, but this data is rarely enough to convince those stubborn detractors. After all, the most robust data insights we have to demonstrate come from within the industry.

However, the reality is that even unlinked data sources provide enough evidence to support the idea that cryptocurrencies are not the first choice of bad actors when it comes to facilitating financial crime. Let’s look at some statistics that show that by far the most popular tools of crime are assets and tools that no one has proposed banning.

Europol: Criminal network in the EU especially with real estate assets

The European Union Agency for Law Enforcement Cooperation (Europol) has a mandate to assist EU Member States in tackling serious international and organized crime, and to look after criminal networks. and large-scale terrorism operating throughout the bloc. The agency’s newly published report provides a comprehensive assessment of the activities of Europe’s most dangerous criminal networks.

What these criminal organizations – specializing in activities such as drug trafficking, online fraud and property crimes – have in common is the need to legitimize ill-gotten gains. When assessing the prevalence of different tools used by criminal networks for this purpose, Europol experts found that real estate is the main means of money laundering (41%), followed by goods. luxury and cash-intensive businesses.

Of these, crypto accounts for only 10% of the laundered money on the list, a far cry from the reality that anti-crypto groups often paint as a dangerous asset class. Additionally, it would make sense for the next edition of the Europol crime networks report to show a lower proportion of money laundered through channels involving digital assets if the year-on-year downward trend is important. observed in most other crime areas as before.

So, the next time you hear someone suggesting that cryptocurrencies should be banned because they are a haven for money launderers, respond with a proposal to ban the sale of houses, luxury watches or newsstands in The area they live in first would make more sense.

Crypto accounts for less than 1% of all illegal proceeds globally

Blockchain analytics firm Chainalysis estimates the total value of digital assets received from illicit addresses throughout 2023 at $24.2 billion, down from $39.6 billion in 2022. The numbers this number represents both assets stolen in cryptocurrency hacks and funds sent to wallets that Chainalysis identified as illegal: addresses linked to ransomware-using groups, fraud, darknet markets, terrorist financing and the largest category by volume – sanctioned entities and jurisdictions. This is perhaps the most rigorous and comprehensive assessment of the scale of criminal activity involving digital assets that we have today.

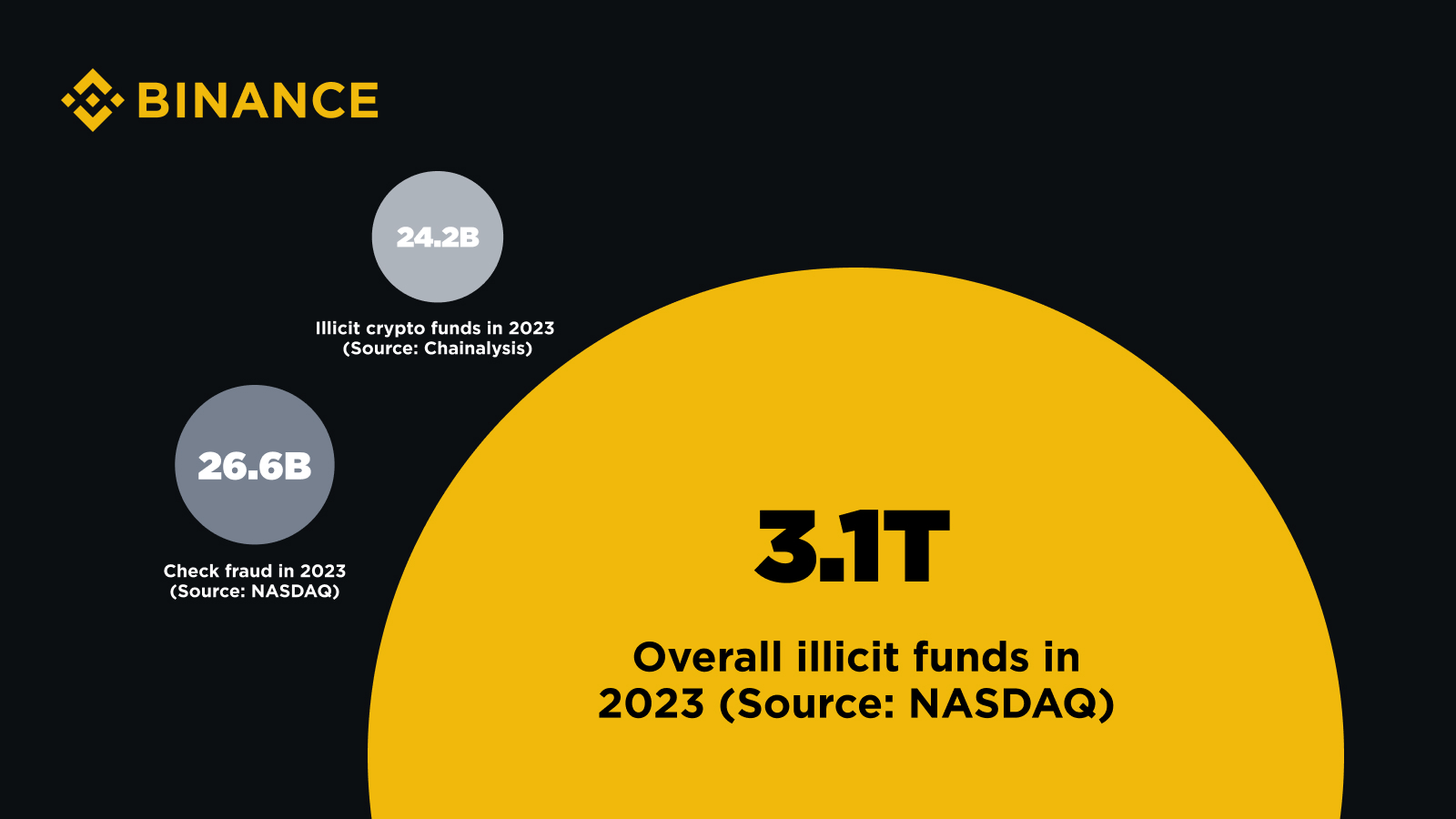

$24 billion may sound like a lot, but how much does this figure account for overall financial crime? NASDAQ’s recent Global Financial Crime Report puts the total amount of illicit funds – including both cryptocurrencies and fiat – handled by the global financial system last year at 3.1 trillion USD.

Although these two numbers cannot be compared perfectly because they are drawn from two separate reports using different methods, they at least help us understand the relative scale of the two phenomena quite well. . 24.2 billion is less than 1% of 3.1 trillion . More specifically, illicit cryptocurrency volume according to Chainalysis accounts for exactly 0.78% of the total global illicit currency volume according to NASDAQ.

To add perspective, the NASDAQ report identifies more than $485 billion in total 2023 losses due to various forms of fraud and scams. One category that generates illegal proceeds comparable to those associated with digital assets is bank check fraud, which cost individuals and businesses $26.6 billion last year, primarily in Americas, where checks are still popular.

In other words, checks – a traditional technology that has persisted largely because of banking’s notable stagnation – are responsible for more financial crime than an entire new asset class that is still perceived. Wrong is a criminal’s paradise. Is it time to ban those cumbersome paper monsters?

Ministry of Finance: Crypto is far inferior to conventional money laundering methods

Every year, the U.S. Department of the Treasury publishes its National Risk Assessment for Money Laundering, Terrorist Financing, and Proliferation Financing, which details key illicit finance vulnerabilities. and the risks that threaten the American people. The 2024 Money Laundering Risk Assessment , while noting existing and developing risk trends related to cryptocurrencies, states that “ the use of virtual assets for money laundering continues to be lower much more than fiat currencies and more common methods that do not involve virtual assets .”

Much of the report focuses on persistent and emerging money laundering risks related to traditional areas such as misuse by legal entities; lack of transparency in some real estate transactions; lack of comprehensive AML/CFT content for related sectors, such as investment advisors; Complicit professionals take advantage of their positions or business activities; and compliance and supervision weaknesses at some regulated financial institutions.

All of these areas demonstrate familiar structural problems inherent in the traditional financial system and corporate operations, highlighting how financial crime is a systemic problem. rather than something that can be blamed on a particular type of technology infrastructure or asset class.

Be the solution instead of the problem

As we look towards the future of finance and consider the direction the industry is headed, it is essential to continually review and demystify outdated and completely flawed perceptions about digital assets . Far from being a popular tool among financial criminals, cryptocurrencies make up a relatively small portion of the total amount of illicit money globally. Data shows that traditional methods and tools such as real estate transactions and traditional banking activities are more common channels of illegal activity such as money laundering.

Instead of using cryptocurrency as a scapegoat for systemic financial crimes, we should pay more attention to these traditional sectors and the problems that are deeply rooted in them. Despite lingering skepticism, compelling data from multiple unaffiliated sources underscores the significant advances in the cryptocurrency industry and how cryptocurrencies are far from ideal for bad actors. A systemic problem requires systemic solutions, and digital assets should be considered part of this solution, not a problem.

Read more

- Crypto crime rates decreased in 2023 and Binance contributed to this trend

- Going the extra mile for users: How Binance helps tackle crime online and offline

- Daily life of Binance investigators