What information do derivative investors need to read every day?

In derivative securities, to limit possible risks when trading, derivative investors need to learn and read more information every day. This will limit the risk of losing money and promptly capture market changes.

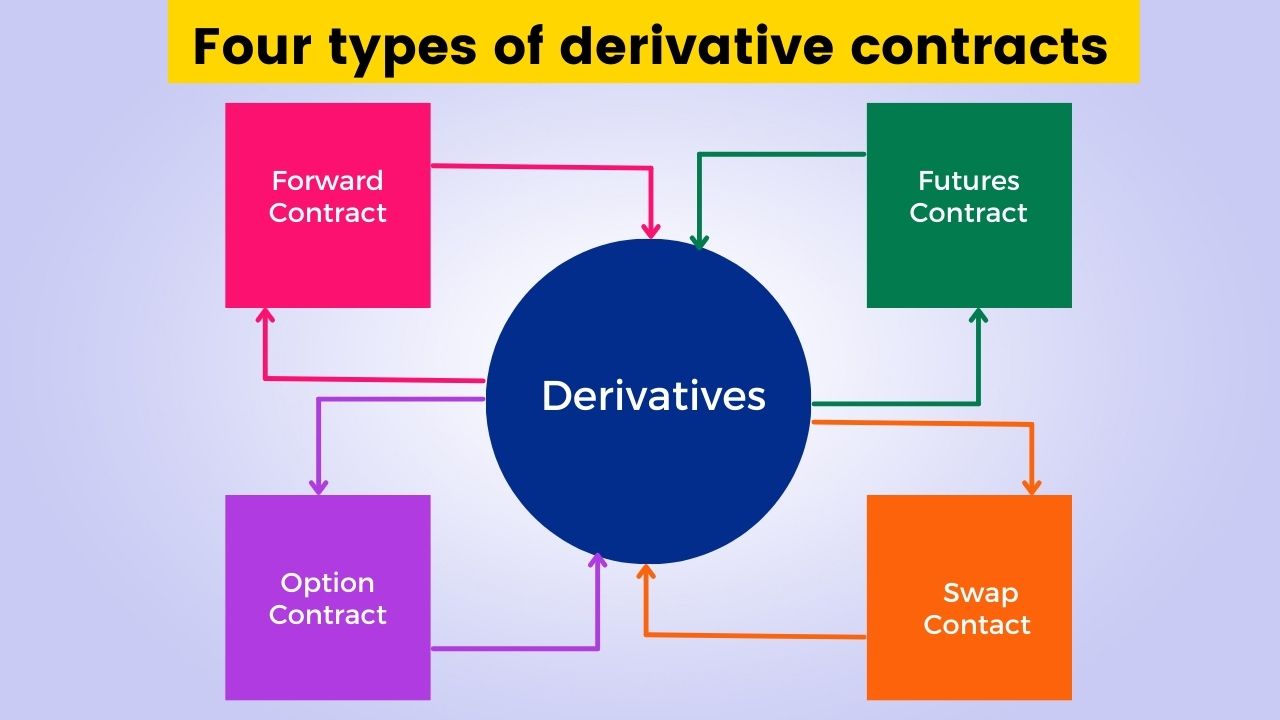

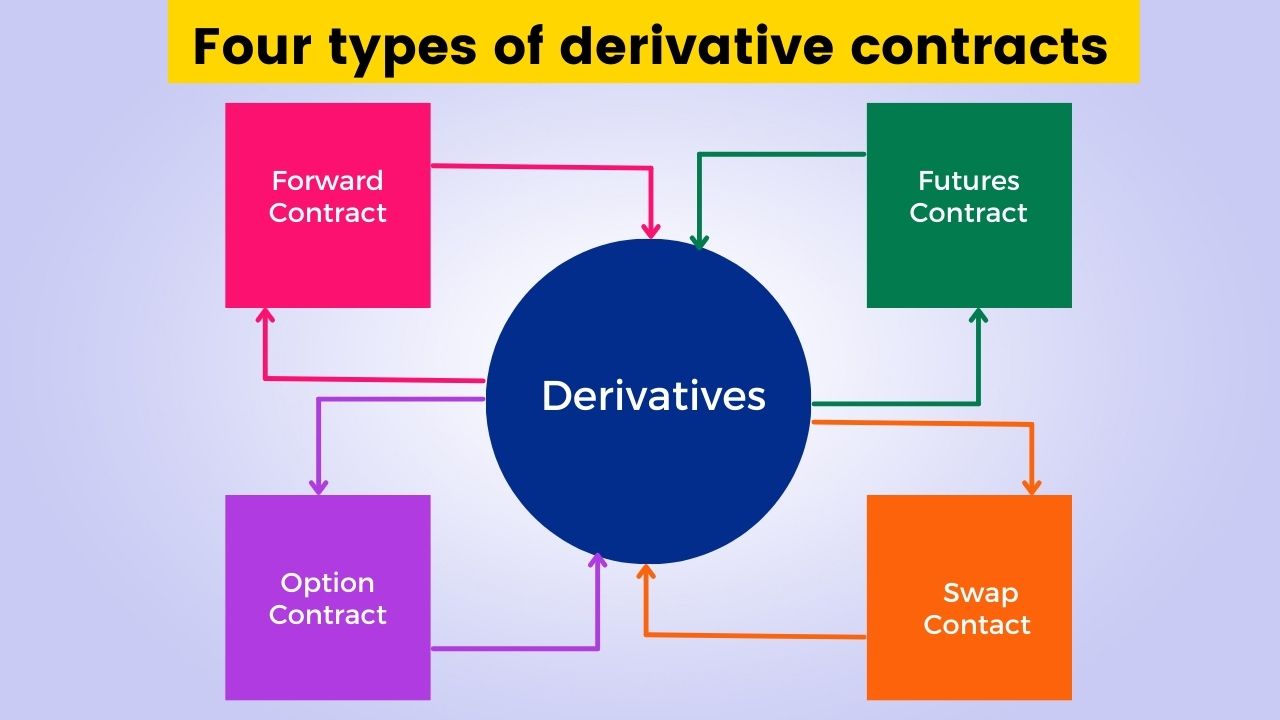

What are derivatives?

Learn about Derivative Securities

Derivative securities (CKPS) are financial instruments in the form of contracts in which the value depends on the VN30 index of the underlying stock. To better understand this definition, CKPS is divided into “securities” and “derivatives”:

- Securities: is an instrument that confirms an investor’s ownership of a portion of a business’s assets or capital.

- Derivative: is a type of financial contract whose value depends on a certain underlying asset. This underlying asset can be financial products or non-financial assets.

Thus, it can be understood that CKPS has specific regulations that at the maturity date, investors need to perform the obligations specified in the contract.

Characteristics of the derivatives market

- It is not a market to mobilize capital but can support and facilitate capital mobilization at reasonable costs.

- Provide means to manage risk

- Market participants (transactions) can choose the desired level of risk to participate in the market.

- Every small fluctuation in the market can bring great efficiency or loss.

- Can sell short, trade T+0

Although derivative securities in Vietnam are influenced by the underlying stock and specifically the VN30 index, because investors can short sell and trade T+0, the information that investors need to pay attention to is: The focus will be on trading trends and focusing on indicators, instead of corporate information and economic situation like underlying stocks.

Information to consider when investing in derivatives

History of derivatives transactions

Tracking derivative fluctuations in the past is very necessary. Normally, investors follow an intraday trading strategy, closely monitoring the market movements of the previous days with a 5-minute candlestick frame to help determine Long/Short fluctuations and trends.

Not only observing and recognizing trends, investors need to combine it with an understanding of indicators, thereby making predictions and trading strategies for the next day/session.

Three important information investors need to pay attention to when participating in derivatives

Monitor market trend forecasts

Many times, investors cannot closely follow the market movements of previous sessions, so the way to get this information can be through newsletters of securities companies.

In these newsletters, in addition to reviewing the previous session’s developments, securities companies also provide trend forecasts for the next session. There are even companies that clearly recommend both resistance and support points so investors can easily make decisions right during the session.

Companies’ recommendations are often based on price patterns in previous sessions. However, this is just a prediction, investors still need to verify these predictions as a “backtest” to choose a forecast with a higher level of accuracy.

Continuously update technologies and products of securities companies

In derivatives trading, a tool that helps investors a lot is trading software and robots (bots). Using robot trading methods with pre-prepared algorithms helps investors react accurately to each market price fluctuation. No longer influenced by psychology when making decisions.

Investors can easily choose a software or bot to optimize their trading efficiency. But then investors will take more time to choose a trading strategy and bot that suits their needs.

Therefore, monitoring the products of securities companies or brokers will help investors quickly know strategies and tools that can help their trading.