What is DCA? How to apply effective price averaging strategy in investing

DCA is a familiar term in the field of financial investment. Join Finhay to find the answer to what DCA is as well as how to apply DCA effectively when investing in the following article.

What is DCA?

DCA stands for Dollar cost Averaging , known as price averaging strategy. In this way, capital is divided and invested at different times, helping to reduce the impact of fluctuations in the trading market compared to buying a large amount of money at once (all in).

Price averaging can be understood as the investor spreading capital into many transactions instead of just investing once. In the current economic situation, this is a popular strategy, helping investors limit risks when their investment portfolio is affected by market fluctuations.

Transactions do not depend too much on the asset price or the time of transaction. Investors do not need to spend most of their time analyzing and calculating to find stocks and coins with the best prices.

You just need to invest systematically according to DCA, dividing the amount equally (or in a specific ratio depending on each person’s capital level), spaced out at regular intervals, regardless of the price. again.

Based on DCA, investors avoid the mistake of making a general investment at the wrong time due to inaccurate asset valuation.

How does the price averaging strategy impact investing?

This strategy is very simple to implement, but the effectiveness is huge. It helps you minimize the risk of ups and downs of the market wave, in return it also helps you gain more profits when the market goes up.

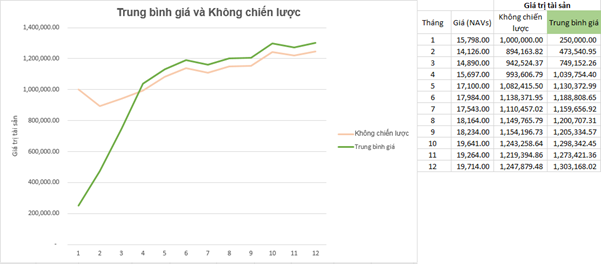

However, the beauty of Average Price has a greater impact in the long term, as you can see below. Do you remember that you invested 1,000,000 VND from the beginning, right? Look below to see the difference between following Averaging and No Strategy.

You see, since the 4th month of pouring, you have seen Average Price increase your value significantly more than non-strategic investing. The reason is simple: The more money you put in at once, the more risk you take with market fluctuations .

People call it “putting eggs in one basket”. When investing non-strategically, the amount of 1 million must bear the entire decline in the first 2 months, and must spend the remaining time to recover. Meanwhile, with the price averaging strategy, not only can losses be reduced to 1/4, but you can also take advantage of low prices to collect more shares.

We can summarize that the Price Averaging strategy brings you the following benefits:

- Buy at a lower price

- Has the potential to own more stocks than with non-strategic investments

- Increase your asset value (or investment value) more

- Minimize the risk of market ups and downs

How to calculate DCA in investment

DCA is applied in financial investment, from the stock market to the cryptocurrency market. There are 3 ways to calculate DCA according to 3 specific cases. Here is a specific example from the cryptocurrency market:

- When the number of new coins purchased is less than the number of old purchases:

1st purchase: 100 BTC for $50,000

Second purchase: 50 BTC for $20,000

⇒ Average price = (100*50,000 + 50*20,000)/150 = $40,000 (this is also the breakeven price)

- When the number of new coins purchased is equal to the amount of old purchases:

1st purchase: 50 BTC for $50,000

Second purchase: 50 BTC for $20,000

⇒ Average equilibrium price = (50,000 +20,000)/2 = $35,000 (breakeven price)

- When the number of coins purchased is more than the original purchase amount:

1st purchase: 50 BTC for $50,000

Second purchase: 100 BTC for $20,000

⇒ Average strong price = (50*50,000+100*20,000)/150 = $30,000 (breakeven price)

Advantages and disadvantages of price averaging strategy

DCA is considered a financial tool for investors to accumulate savings assets over a long-term period. You can neutralize the short-term volatility of your equity, thereby avoiding the risks that are common when trading frequently.

Thanks to its ability to reduce risks, shorten breakeven and increase profits for investors,… DCA is increasingly popular. Whether you are an experienced trader or new to the market, choosing the DCA method is a priority.

However, to average the price favorably, you need to note the pros and cons of this approach.

Advantage

DCA has many outstanding advantages, and is loved and chosen by investors in their investment strategies. So what are the advantages of DCA?

Using DCA reduces the risk of emotional investing

Newcomers who do not have much experience often decide to spend money based on emotion. If you are lucky, you will make a profit, but most of the time you will lose money due to unfounded decisions made mainly based on hunches and luck mentality.

If using DCA, investors reduce the possibility of being affected by FOMO (Fear of missing out) in the market. You are required to build a scientific investment plan. If you put money down, you will have better control than if you see a code you like, hear rumors, trust others and then buy regardless.

Don’t put too much emphasis on the right time and the right specific code

No matter how experienced you are, there will still be times when you make wrong decisions because your initial judgment is skewed by market influences. With DCA, you don’t need to time every second to enter orders or lock in deviations. Your capital is spread evenly throughout the investment process, so the risk of entering an order at the wrong time is less.

Save investment costs

No need to have too much capital, just spend a certain amount of money within your ability to apply DCA to investment. Capital will be gradually accumulated as savings. This is a long-term investment method, less risky than other methods.

Save investment time

Investors do not need to focus too much time every day on monitoring price fluctuations, market fluctuations, etc. Just apply the DCA strategy we built to be able to invest scientifically and effectively.

Note: not spending a lot of time does not mean skipping market monitoring. No matter what field or playing field there are rules, detecting volatility signals in advance helps you invest more effectively.

Shorten break-even time

The lower the average price, the closer the break-even point. Compared to all-in investment, the break-even point will be lower. Besides, the faster DCA breaks even, the higher its profitability.

Defect

- The first disadvantage to mention is the cost of transaction activities. Because the capital is divided into small pieces, you will make many transactions with small volumes according to the price averaging strategy. Transactions are charged, the more transactions, the higher the fee.

- Next is the lower profit compared to all in. In case you go all in on a good code with development potential, the money you earn is huge. In case you DCA on junk codes, the risk of being left completely empty-handed can occur. If you accept low profits, the risk is also low.

In general, DCA is a suitable investment method for those with modest capital, do not like risk, and want safety in the investment process. For traders who want to take advantage of changes in stock prices to make huge profits, DCA is not the first choice.

Instructions for applying effective DCA strategies

Stock DCA is a long-term strategy, you should prepare psychological stability and confidence in your investment portfolio. DCA should be applied to strong stock codes such as VN30, HNX30,… in the field of cryptocurrency, DCA should be used with coins with strong foundations such as BTC, BNB, ETH,…

In case the market is going down (Downtrend): Do not use DCA because the risk of burning your account is very high. When the market grows and stock codes increase sharply, DCA reduces profits compared to all in.

In case the market is trending and there are strong support levels nearby, it is the appropriate time to apply DCA.

To apply the DCA strategy, you can follow these steps:

- Step 1: Determine specifically the highest level of loss you can accept. This helps to be mentally prepared if unfortunately the plan goes awry. It is necessary to ensure that the loss does not exceed 5 – 10% of the account.

- Step 2: Calculate the total order volume corresponding to the capital amount.

- Step 3: Make an appropriate capital allocation plan. Buy and place transactions periodically every week, every month,… and divided in ratios of 3:3:4, 2:3:5,… depending on risk appetite (maximum risk tolerance of each person). in step 1).

- Step 4: Determine and plan specifically when to enter orders, take profits, and cut losses.

- Step 5: Choose a reasonable time to conduct DCA.

What to note when using the DCA strategy in investing

To apply stock DCA effectively, you need to pay attention to the following issues:

- Find and make a suitable investment list. The market has thousands of transaction codes, with even more junk codes. Especially in the cryptocurrency market, there are countless garbage coins. Sometimes they become “attractive” because the “sharks” intentionally manipulate prices, increase them, and then fall to the bottom. The more they own, the more investors lose. DCA will be safer and more effective with good codes and good coins. They have a solid foundation and foundation for future development.

- Applying DCA price averaging should keep an eye on price fluctuations if you plan to buy more coins. Assuming you have made a profit after DCA, you want to buy more new assets and need to know what price to buy and how much to buy. Don’t rush to buy more when the price shows signs of decreasing.

- Do not use DCA when the market is in a long-term Downtrend. Because at this time, it will be difficult for you to determine where the top and bottom of the market are. What you need to do now is to closely monitor market fluctuations.

The investment method applying the DCA price averaging strategy does not help you completely eliminate investment risks. You should still update information, evaluate and evaluate the market based on specific signals. An important note, caution should be exercised when using DCA if using financial leverage. It’s best to only use one of the two to ensure your financial safety.

Above are shared answers to the question of what DCA is. This is an important investment strategy that anyone participating in the market should know. Applying DCA effectively helps deliver better investment results. Hopefully Finhay’s readers have a clear understanding of DCA, and thus know how to apply it to their investment plans.