What is DYDX? Evaluate the project & pros and cons and development potential

In recent years, the field of cryptocurrency has been growing, attracting the attention of many investors. Along with that, decentralized exchanges were born, including DYDX . To help investors better understand this exchange, Finhay’s article below will introduce basic information as well as the potential of DYDX.

What is DYDX?

DYDX is a decentralized exchange whose main products are spot trading, futures contracts and margin trading. This exchange belongs to the Ethereum network. DYDX is of interest to many investors thanks to its friendly interface, ease of use, fast transactions, low costs and high liquidity.

Who founded DYDX?

The DYDX exchange project has the investment capital participation of many large companies and investment funds such as Andreessen Horowitz, Polychain Capital, a16z crypto… The development team includes 4 key members:

- Antonio Juliano (founder): Former software engineer of tokenbase and Uber. At the same time, Antonio Juliano is also the founder of the Weipoint application.

- Brendan Chou (software engineer): Experienced working at Google and Bloomberg.

- Zhuo Xun Yin (operations director): Used to work at Nimble Pharmacy and consultant at Bain & Company.

- Bryce Neal (software engineer): He was a software engineer at NerdWallet, Betable, and Amazon.

How does DYDX work?

DYDX exchange is currently a formidable competitor in the cryptocurrency market. Currently, DYDX has about 70,000 traders, earning profits of about 11 billion dollars, TVL value increases over time. DYDX ranks first in the list of platforms providing derivative products according to TVL value.

Currently, DYDX operates in 2 layers providing Defi products, including:

- Margin & Spot trading on Layer 1 of Ethereum: This is a trading platform that runs on smart contracts in the Ethereum blockchain, allowing transactions without any intermediaries.

- Perpetual transaction (perpetual): This is a newly released transaction, provided by Starkware.

Some key products and features of the DYDX trading platform include:

- Providing Margin & Spot trading for investors with leverage up to 5 times, supporting three currency pairs: ETH-DAI, ETH-USDC and DAI-USDC.

- Provides Perpetual trading with up to 10x leverage, supported through three pairs: BTC-USD, ETH-USD, LINK-USD.

- Offers lending with no waiting period and no minimum loan, support for ETH, DAI and USDC tokens.

- Borrow with minimum collateral of 125%, support DAI, ETH and USDC tokens, collateral must be above 115% to avoid liquidation.

In addition to the above products, DYDX also supports participants in portfolio management. Thereby helping investors control transactions and receive discounted fees based on the volume of transactions performed. DYDX also publicly provides useful data sources and price predictions for participants.

Learn about DYDX tokens

To trade on any exchange, investors need to learn about the currency and how to own that asset. Currently, DYDX has also developed its own currency for the exchange, which is DYDX token.

What is DYDX token?

DYDX token is the currency used on the DYDX exchange to perform spot transactions, margin transactions, futures contracts…

How to earn and own

The new DYDX token was launched on August 3, 2021, and has not been widely distributed in the community and many exchanges. To own DYDX tokens, investors can do the following:

- Participate and make transactions on DYDX for retroactive opportunities.

- Implement liquidity provision in liquidity pools.

- Stake USDC or DYDX to receive additional DYDX tokens.

In addition, investors can own DYDX tokens in a number of other ways such as:

- Trading Rewards: 25% (equivalent to 250,000,000 DYDX tokens) are distributed to users trading on the DYDX Layer 2 protocol.

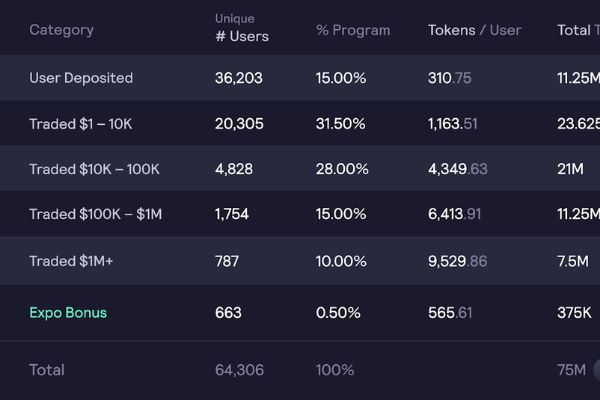

- Retroactive Mining Rewards: This is a reward for users, 7.5% (equivalent to 75,000,000 DYDX) is distributed for this purpose.

- Airdrop applies to users who have traded Perpetual, Margin, Spot on DYDX Protocol on Layer 2, Layer 1 or deposited assets into borrow/ supply pools.

Pros and cons of DYDX

DYDX provides many useful utilities, features and services for investors, helping users easily trade. So specifically, what are the advantages and disadvantages of this trading platform?

Advantage

The DYDX exchange is currently one of the exchanges that attracts the most attention from investors. The reason is because DYDX possesses many outstanding advantages such as:

- Price transparency: All trading pairs on DYDX are provided by a third party, Chainlink. Thereby helping to minimize the possibility of a monopoly floor manipulating transaction prices.

- Borrow and mortgage assets: With DYDX, investors can use their digital assets to borrow on margin and lend to receive income.

- Portfolio management: The floor provides the “Portfolio” function, all investor transactions are summarized here. This helps investors manage their transactions and easily plan their investments.

- Security and privacy: By using Layer2’s Starkware technology solution, DYDX will ensure information security for participants based on Zero-Knowledge Rollups.

- Reputable founding team: DYDX’s founding team is experienced, dedicated to the project, reputable in the crypto market and supported by many people.

- Large source of funding: DYDX is receiving sponsorship from many famous organizations. The number of deposit wallets increased 4.8 times from 8,000 to 38,588 wallets. The amount of loans from Lending Pool is nearly 17.4 billion USD.

- In just 1 year, from 2019 to 2020, trading volume increased 40 times from $63 million to $2.5 billion. Of which, Spot and Margin transactions reached $1.9 billion, and non-term contract transactions reached $563 million.

Defect

Despite its outstanding advantages, DYDX also has some limitations and challenges that need to be faced:

- DYDX has many major competitors in the derivatives field such as Curve Finance, SushiSwap, Aave, Compound…

- Investors are used to trading on the CEX exchanges, DYDX is the newest exchange, so it takes time for investors to get used to and realize the potential of this exchange.

- The currency pairs DYDX is supporting are quite limited, not yet supporting USDT.

- DYDX token price fluctuates strongly, depending heavily on general market fluctuations.

Should you invest in DYDX?

The current cryptocurrency market is developing rapidly, many trading platforms have been established. In particular, decentralized exchanges are more attractive to investors, and it is expected that many people will participate in the future.

DYDX is the most prominent decentralized exchange, overcoming all the disadvantages and taking advantage of the advantages of previous exchanges such as DEX and CEX. Therefore, DYDX will be one of the important decentralized exchanges in the future. At the same time, the DYDX token will have a lot of potential for future development and is a suitable choice for long-term investment consideration.

Above is basic information about the DYDX exchange. It can be seen that DYDX is an exchange with many advantages and potential for future development. However, the current cryptocurrency market still has many potential risks, investors should consider investing with a reasonable amount of capital to prevent these risks from occurring.