What is industry merger? Current types of mergers

Besides mergers between companies in different industries, mergers between companies in the same industry are quite common. Let’s join DNSE to learn the core content surrounding this issue.

What is industry merger?

Learn about Mergers by Industry

Congeneric Merger , or Congeneric Merger, is a form of merger in which two companies or organizations are related to the same industry or market, but offer different product lines.

This situation occurs when a target company and an acquiring company merge to take advantage of common technology or manufacturing processes to expand product lines or increase market share.

In the case of a product expansion merger, one company’s product line is added to another company’s product line. This helps the merged business have the opportunity to reach a larger number of customers, thereby increasing market share and profits.

Characteristics of mergers by industry

Two companies involved in an industry merger may share manufacturing processes, distribution channels, marketing or technology…

- Industry-based mergers can help the acquiring company quickly increase its market share or expand its product lines.

- Similarities between two companies in an industry merger, can create synergy. In particular, the performance of the merger far exceeds the performance of each individual company.

Other types of business mergers

Although there are many reasons why companies conduct mergers, common factors include: business growth potential, product diversification and optimizing cost efficiency.

And for businesses to achieve the above goal, sometimes mergers do not need to take place in the same industry.

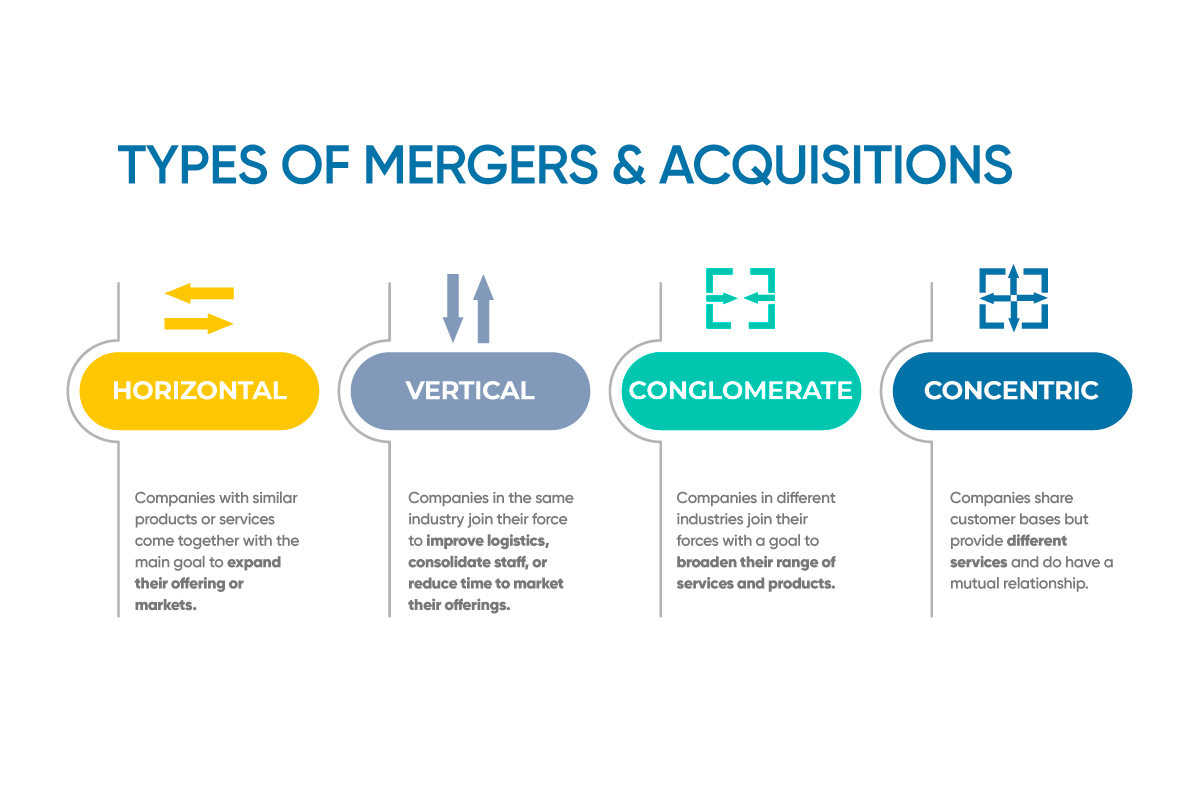

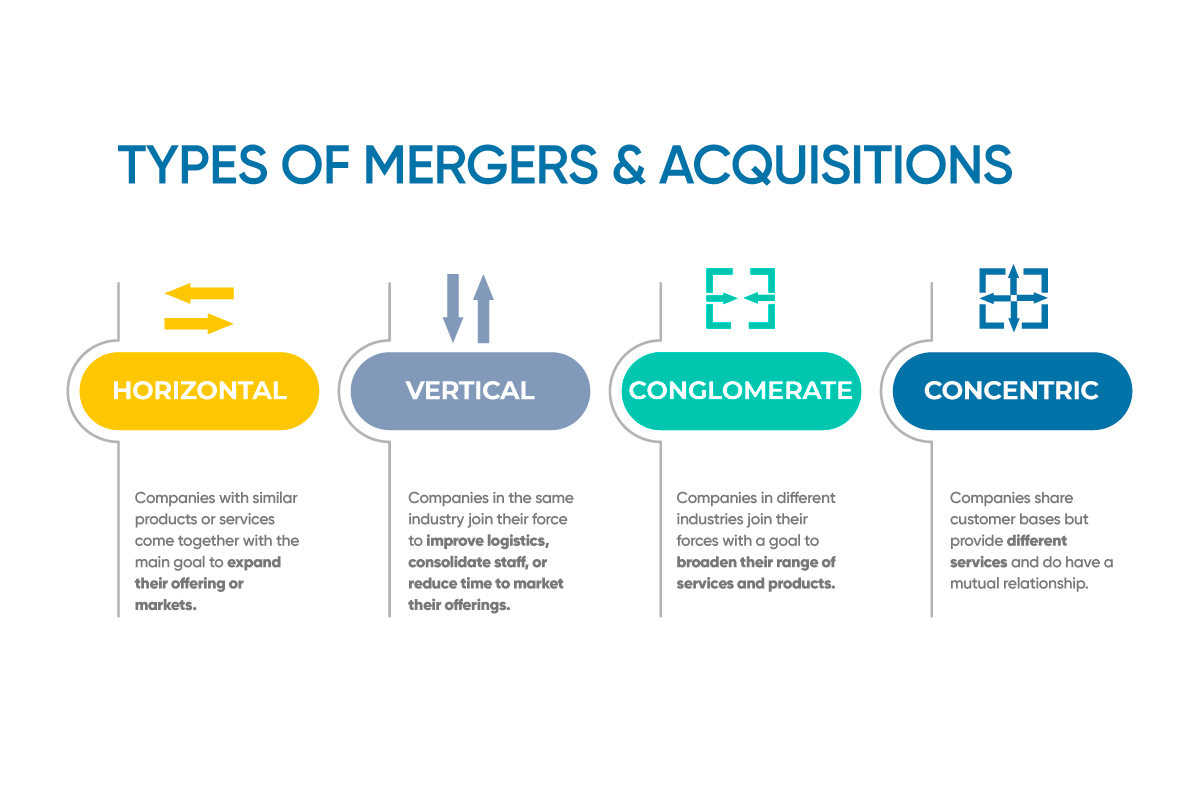

Types of business mergers are divided into 3 types

Conglomerate Merger

In contrast to industry mergers, conglomerate mergers occur between companies that have no connection to each other. Corporations seek to diversify their companies by owning multiple unrelated products or businesses.

This diversification is part of an overall risk management strategy that helps the company weather downturns or market volatility.

Horizontal Merger (Horizontal Merger)

Horizontal mergers involve two competing companies in the same industry merging to form a larger company.

The potential increase in market share is the main driving force behind this merger. Besides, it can also bring cost-saving benefits through economies of scale.

Vertical Merger

Vertical mergers occur when two businesses participate in the process of producing goods, or providing services at different stages of the production process.

This enables the company to control its supply process by acquiring companies that produce raw materials or the front and back stages of the production process.

Real-life examples of mergers by industry

An example of a joint merger is when banking giant Citicorp merged with financial services company Travelers Group in 1998.

In a deal worth $70 billion, the two companies joined forces to form Citigroup Inc. Although both companies operate in the financial services industry, they have different product lines.

Citicorp provides consumers with traditional banking and credit card services. On the other hand, Travelers is known for its brokerage and insurance services.

The natural merger between these two companies has allowed Citigroup to become one of the largest financial services companies in the world.

Business mergers bring many benefits to businesses in production business activities. Contribute to improving competitiveness and bringing about market diversity for exploitation and development.