Why do stock prices drop sharply after additional issuance?

If you follow the stock market every day, you must have witnessed a few stock codes dropping very sharply in price right in the At the Open (ATO) session, even exceeding the daily price fluctuation range. One of the reasons why stock prices decrease is because businesses have issued new shares. So why did the stock price drop sharply after additional issuance? The content below from DNSE will help you answer this question.

Stock prices decrease after businesses issue additional shares

What is issuing additional shares?

Issuing additional shares is also considered one of the ways to split shares. It sounds a bit counterintuitive, but it can be simply understood as a way to increase the number of shares of a business. In the stock market today, there are the following ways to split stocks:

- Dividends in shares

- Issue stock purchase rights at preferential prices to existing shareholders

- Issuing individual shares

- Issuing shares to employees in the company (ESOP)

Why do businesses issue more shares?

Issuing additional shares is generally beneficial for both businesses and investors. As follows:

From a business perspective:

Issuing additional shares helps increase the number of outstanding shares of a business. This leads to increased stock liquidity. The quantity increases, the value of shares decreases, this will attract more capital from investors.

From an investor perspective:

The number of shares will increase after the company issues more shares. Investors who do not own this stock will have the opportunity to buy at a more attractive price.

Existing shareholders will have the opportunity to own more shares when they use the right to buy additional shares issued. However, shareholders need to pay attention at this time. Because if they do not use the right to buy at a preferential price, they will still keep the same number of shares but their value will be reduced compared to the listed price on the market on the ex-rights trading day.

Does a business issuing additional shares make shareholders worried?

For example: A has 1,000 shares of XYZ worth 100,000,000 VND, equivalent to 100,000 VND/share (excluding transaction fees). A has the right to buy additional shares issued for 10,000 VND, at a ratio of 1:1. With this ratio, A has the right to buy 1,000 more shares. The price of XYZ stock on the market at this time will be only 55,000 VND/share. Here, A will have 2 options:

- A uses 10,000,000 to buy 1,000 additional shares (excluding transaction fees). From there, A averages the purchase price of XYZ stock as follows:

(100,000,000 + 10,000,000) / 2,000 = 55,000

55,000 is also the price of 1 XYZ stock on the market at this time.

- A does not use the right to buy additional shares issued. Thus, A still only owns 1,000 shares of XYZ at a price of 100,000 VND/share. However, at this time, the price of XYZ on the market has dropped to 55,000 VND/share. If you sell 1,000 shares right now, A will lose 45,000,000 VND, equivalent to 45,000/share (excluding taxes and transaction fees).

The reason why the stock price after additional issuance decreased sharply

Basically, even if additional shares are issued, the company’s equity does not change. Only the number of shares after additional issuance will increase. Thus, the par value of each share will be reduced.

It can be simply understood as follows: You have a 100,000 VND bill. Then you change this bill into 10 bills of 10,000 VND. Your amount of money is still the same, the only difference is that instead of having 1 banknote, you will now own 10 bills with smaller denominations. This is the reason why the stock price after additional issuance drops sharply.

Are stock splits good for shareholders?

How to calculate stock price after additional issuance

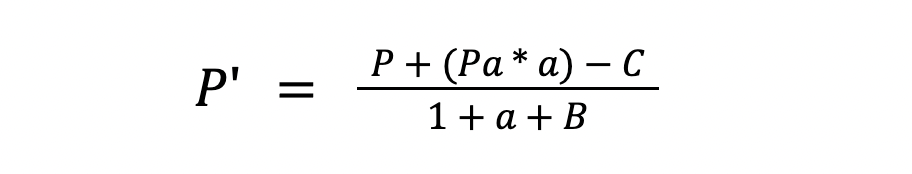

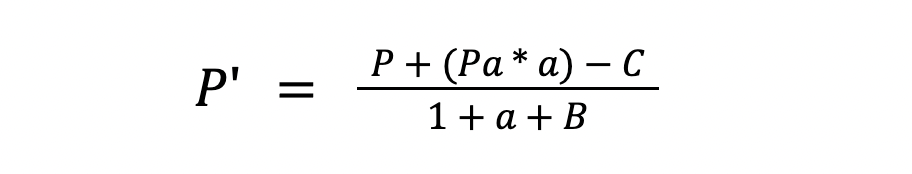

We have a formula to calculate the stock price after additional issuance (ie after the ex-dividend date):

In there:

- P’: Stock price on the ex-dividend date

- P: Stock price before the ex-dividend date

- Pa: Price of additional shares issued

- a: Ratio of additional shares issued

- C: Cash dividends

- B: Stock dividend ratio

For example: In the event that VNDirect Securities Company pays dividends and issues stock purchase rights at preferential prices, we have the following data:

- VND stock price before ex-dividend date (March 9, 2022): P = 73,500 VND.

- VND pays dividends at a ratio of 100:80, equivalent to 80%. B = 0.8

- VND issues stock purchase rights at a preferential price of 10,000/share with a ratio of 1:1. Pa = 10,000; a = 1

- VND does not pay dividends in cash. C = 0

Applying the data to the above formula, we have:

Thus, 1 VND share on the ex-rights trading day has a par value of 29,800 VND.

Hopefully the above content has explained to you why the stock price after additional issuance decreases. Every year, many businesses pay dividends and issue additional shares. Monitoring a company’s business performance is extremely necessary for investors to make informed decisions.

On DNSE’s Entrade X app, the latest news and analysis are recommended daily. Investors can promptly grasp hot news to promptly carry out buying and selling transactions and avoid losses. Click on Open a stock account now and experience EntradeX